CA Affidavit of Collection of Personal Property free printable template

Show details

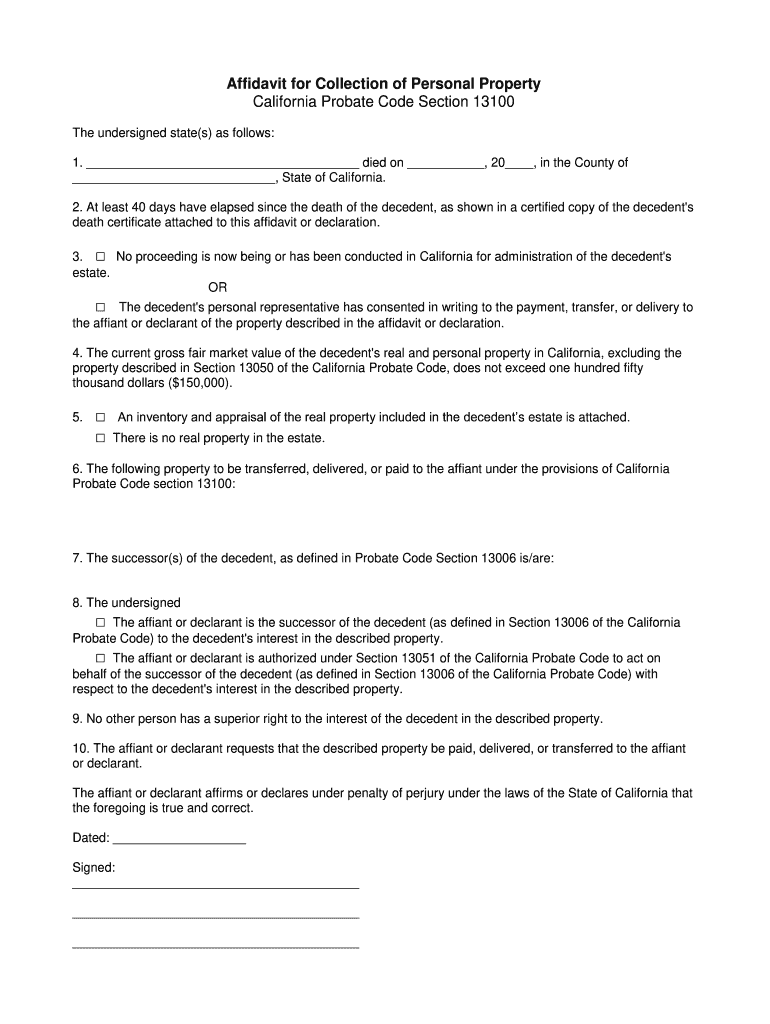

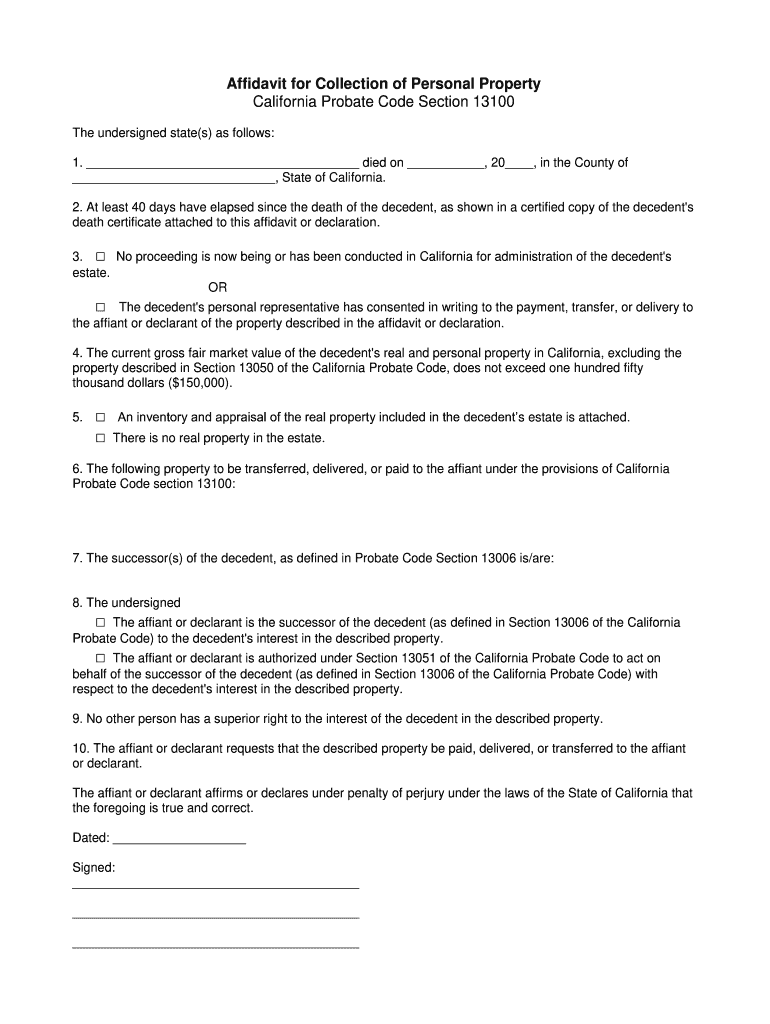

Affidavit for Collection of Personal Property California Probate Code Section 13100 The undersigned state s as follows 1. OR The decedent s personal representative has consented in writing to the payment transfer or delivery to the affiant or declarant of the property described in the affidavit or declaration. 4. died on 20 in the County of 2. At least 40 days have elapsed since the death of the decedent as shown in a certified copy of the decedent s death certificate attached to this...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign affidavit for collection of personal property california form

Edit your affidavit for collection of personal property in ca form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit of collection of personal property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit affidavit for collection of personal property ca online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit affidavit for personal property form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out affidavit ca form

How to fill out CA Affidavit of Collection of Personal Property

01

Obtain the CA Affidavit of Collection of Personal Property form from the court or online.

02

Fill out the decedent's details, including their name, date of death, and last known address.

03

List the personal property you wish to collect, ensuring it is valued at $166,250 or less.

04

Provide information about your relationship to the deceased.

05

Sign and date the affidavit in the presence of a notary public, if required.

06

File the completed affidavit with the appropriate court.

Who needs CA Affidavit of Collection of Personal Property?

01

Any individual claiming personal property of a deceased person who does not require a formal probate process.

02

Heirs or beneficiaries named in the will or those entitled to inherit under state law.

Fill

affidavit personal property

: Try Risk Free

People Also Ask about california 13100 state form

How do I fill out an affidavit for collection of personal property in Hawaii?

Step 1 – Make a List of Assets. You can do this in a simple spreadsheet. Step 2 – Download and Prepare Affidavit. Download Form 3C-E-210 and fill it out. Step 3 – Get Affidavit Notarized. When you have completed the affidavit, you must swear to it and sign it before a notary public. Step 4 – Collect the Assets.

What is an Illinois affidavit for collection of personal property?

An Illinois small estate affidavit provides a streamlined way for an heir to gather and distribute the assets of a person who died, provided that the estate does not exceed $100,000. This form allows an heir to collect the personal property of the decedent without going to court.

What is the probate code 13100 amount for 2022?

To use the affidavit for small estates under Probate Code §13100, the value of an estate must be no larger than $184,500. (For deaths prior to April 1, 2022, the maximum value of an estate that could use the small estate affidavit was $166,250.)

What is probate code 13100 13106?

Sections 13100-13106: The legal citation for the rules that outline Small Estate Affidavit requirements and procedures. died. Decedent's Estate: All real and personal property that a person owned at the time of death.

What is California affidavit for collection of personal property?

California Small Estate Affidavit (Affidavit for Collection of Personal Property) Create a high quality document online now! A California small estate affidavit, or “Petition to Determine Succession to Real Property,” is used by the rightful heirs to an estate of a person who died (the “decedent”).

What is CA Probate Code 13100 affidavit?

Code §§ 13100-13116, the person(s) entitled to the property may present a Small Estate Affidavit, commonly known as an Affidavit for Collection of Personal Property, to the person or institution having custody of the property, requesting that the property be delivered or transferred to the successor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my affidavit for collection of personal property form directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your real affidavit personal and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send california affidavit for collection of personal property for eSignature?

When you're ready to share your affidavit collection personal property ca form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out affidavit for collection of personal in ca on an Android device?

Use the pdfFiller mobile app and complete your affidavit collection personal property ca and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CA Affidavit of Collection of Personal Property?

The CA Affidavit of Collection of Personal Property is a legal document that allows a person to collect personal property from a deceased individual's estate without going through probate, provided they meet certain criteria.

Who is required to file CA Affidavit of Collection of Personal Property?

Individuals who are entitled to receive property from a deceased person's estate, usually heirs or beneficiaries, are required to file the CA Affidavit of Collection of Personal Property.

How to fill out CA Affidavit of Collection of Personal Property?

To fill out the CA Affidavit of Collection of Personal Property, the filer must provide their information, details about the deceased, and a description of the personal property being collected. It must be signed under penalty of perjury.

What is the purpose of CA Affidavit of Collection of Personal Property?

The purpose of the CA Affidavit of Collection of Personal Property is to streamline the transfer of personal property to heirs or beneficiaries without the need for a lengthy probate process.

What information must be reported on CA Affidavit of Collection of Personal Property?

The information that must be reported includes the name and date of death of the deceased, the name of the affiant, the relationship to the deceased, a list of the property being collected, and the date of signing.

Fill out your CA Affidavit of Collection of Personal Property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Deceased is not the form you're looking for?Search for another form here.

Keywords relevant to affidavit for collection of small estate

Related to ca affidavit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.